FY 23 Budget Q&A #072: Is there a specific percentage of assessed real estate values or percentage of city debt obligations, etc, that they are recommending that we can use to measure whether we are in the range they are looking for?

Page updated on September 20, 2024 at 11:13 AM

XWARNING: You have chosen to translate this page using an automated translation system.

This translation has not been reviewed by the City of Alexandria and may contain errors.

Budget Question # 072: Regarding the desire of rating agencies for localities to increase their general fund balances mentioned on page 9.3, is there a specific percentage of assessed real estate values or percentage of city debt obligations, etc, that they are recommending that we can use to measure whether we are in the range they are looking for? Do we have a defined “target” for this balance? (Councilman McPike)

Response:

Fund Balance Target:

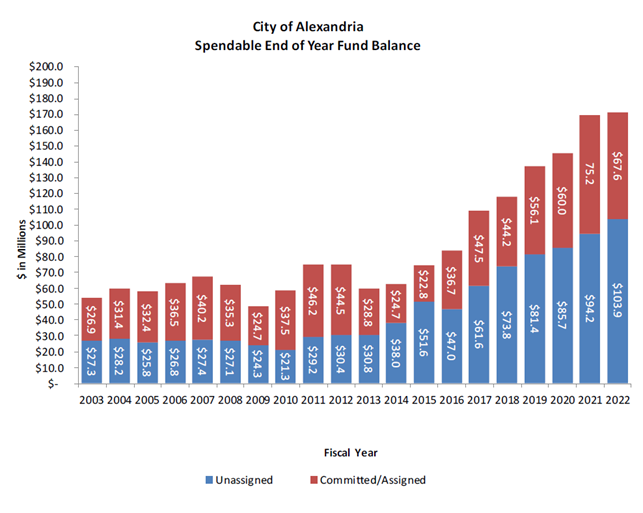

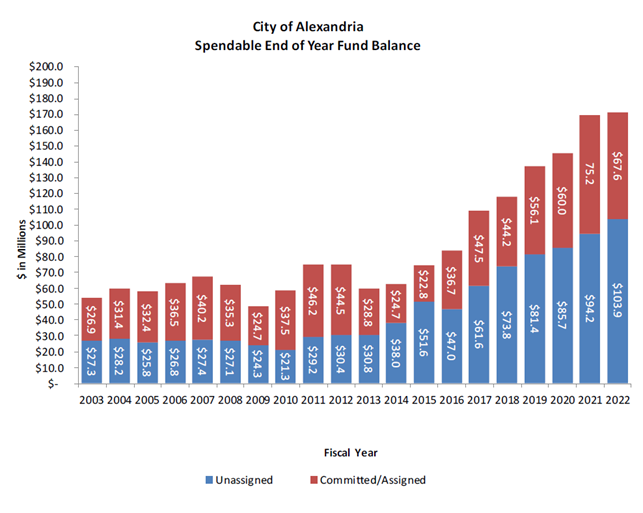

In November 2019, City Council updated the Debt-Related Financial Policies, establishing a 15% target for spendable fund balance as a percentage of general fund revenue. Spendable fund balance is projected to be $171.5 million as of June 30, 2022, which represents 22% of FY 2022 estimated General Fund Revenues.

Rating Agency Recommendations:

Spendable Fund Balance are resources that City Council can use to fund unforeseen, unbudgeted, one-time needs. Within Spendable Fund Balance, Committed and Assigned funds have been designated for a specific intended purpose, such as natural disasters, incomplete projects or future capital budgets. Although these are the stated intentions, Committed and Assigned fund balance can be used for any purpose, should circumstances change. The remaining Spendable Fund Balance has no designated purpose and is available for one-time uses.

Moody’s Investors Service have indicated that our Fund Balance as a percent of revenues of 20.78% is satisfactory, according to the Credit Opinion in November 2021. The specific comments regarding Alexandria’s Financial position are below:

“Fiscal 2020 ended with a $6.7 million operating surplus due to strong revenue growth, bringing total general fund balance to $152.8 million, or a satisfactory 20.7% of revenues, which is below the Aaa median as a percentage of revenues but above the Aaa median on an absolute basis. Available general fund balance (total less non-spendable and restricted amounts) represented 19.7% of revenues. Because Virginia cities’ operating funds include school operations, the median operating fund balance is generally lower than national medians. However, given the strong institutional framework we assign to VA cities, which reflects their significant revenue raising and expenditure cutting abilities, in addition to the larger size of Alexandria's operating budget, the city's overall financial positions is strong despite the lower reserve metric.”

It should be noted that the City has made a concerted effort to increase Fund Balance, and City Council policy was updated in FY 2020 to ensure that this target is maintained. S&P Global acknowledged this policy in November 2019 and views the target of 15% as a minimum:

“Alexandria's fiscal 2022 expenditures are almost 5% higher than the previous year actuals and the city budgeted for a $10 million use of reserves. Although it is still early in the fiscal year, city officials indicate that this draw may not materialize. As a result, we expect Alexandria will continue to build on its track record of strong financial performance and maintenance of very strong reserves, both in nominal terms and as a share of expenditures. We are confident Alexandria will remain in compliance with its formal policy to hold a minimum reserve of 15% of general fund revenue, which in fiscal 2022 equals slightly more than $112 million, a threshold it materially exceeds.”