Real Estate Tax Relief and Assistance Program for Elderly and Disabled Persons

Please note, our taxpayer counters at City Hall ceased operations as of close of business on January 9, 2026. The counters will remain closed during the renovation of City Hall. Walk-in service is still available at 4850 Mark Center Drive, Suite 2011, 8 AM – 5 PM, Monday through Friday. In-Person assistance by appointment only during City Hall Renovations:100 N Pitt ST, Suite: 426 by calling 703.746.4800, Option 6. Assistance is also available by email at taxrelief@alexandriava.gov, or by calling 703-746-4800, option 6.

Real Estate Tax Relief and Assistance Program for Elderly and Disabled Persons

Residents of the City of Alexandria who are either 65 years of age or older or permanently and totally disabled, or become such during the current calendar year, may be eligible for the City's Real Estate Tax Relief Program for Elderly and Disabled Persons. Tax relief may be prorated for persons who turn 65 or who become disabled during the year. Applications for Real Estate tax relief are due by April 15 each year. Extensions may be granted for late applications for 1st time filers or for hardship circumstances. Please contact taxrelief@alexandriava.gov to discuss late applications.

NOTE: Please do not send any documents or messages that contain personal or confidential information to City email addresses. If you need to submit documents that contain personal or confidential information, please email taxrelief@alexandriava.gov or call 703.746.4800 to request a secure link for uploading confidential documents.

Program Requirements

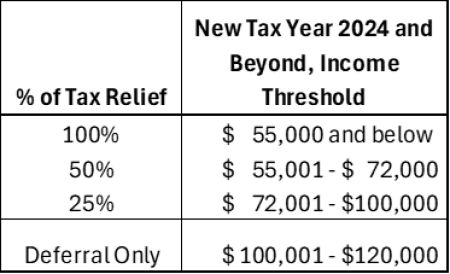

- Total combined gross household income includes the income of the applicant and, if living in the home, the income of the applicant's spouse and any other owners. Gross household income also includes any income in excess of $10,000 per year for any other relatives of the owners who are living in the home.

- Taxes over the relieved amount may also be deferred at the request of the applicant.

- Only deferred taxes need to be repaid, with interest, at the time of conveyance or upon demise of the owner. Relieved taxes do not need to be repaid.

- Net assets of the household may not exceed $430,000. "Net" means total assets (such as cash, IRA accounts, stocks, bonds, property other than your principal home) minus your liabilities. Do not include the value of your home (residence) and up to one acre of land upon which it sits in your total assets; likewise, do not include your associated mortgage on the home in your liabilities.

Disabled Persons

Permanently and totally disabled persons must attach to the application or affidavit form, certification of their disability from the Social Security Administration Office, the Department of Veterans Affairs or the Railroad Retirement Board, or a sworn affidavit by two medical doctors licensed to practice in the Commonwealth of Virginia. The certification or affidavit must state that the applicant is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment or deformity which can be expected to last for the duration of the applicant’s life.

Verification of Income and Assets

All applicants must attach copies of documents to support income, e.g., Social Security statements (SSA-1099), Railroad Retirement (RRB-1099), pension statements (1009-R), wages (W-2), interest income (1099-INT), dividend income (1099-DIV), divorce agreements, leases, and year-end financial statements, etc. Applicants required to file a Federal Income Tax Returns must provide a copy of the tax returns (with all attachments).

Filing and Application

2026 Elderly and/or Disabled Tax Relief Application

Completed applications or annual certifications must be filed with the Department of Finance by April 15th.

Late Application: Normally, late applications can be accepted no later than April 15 of the following calendar year, provided the delay was due to good cause, such as hospitalization, medical illness, or being a first-time applicant. No late applications will be accepted for any reason beyond this hardship date (Section 3-2-165(c), Code of the City of Alexandria).

Any resident wishing to receive an application by mail should contact:

Please note, our taxpayer counters at City Hall ceased operations as of close of business on January 9, 2026. The counters will remain closed during the renovation of City Hall. Walk-in service is still available at 4850 Mark Center Drive, Suite 2011, 8 AM – 5 PM, Monday through Friday. In-Person assistance by appointment only during City Hall Renovations:100 N Pitt ST, Suite: 426 by calling 703.746.4800, Option 6. Assistance is also available by email at taxrelief@alexandriava.gov, or by calling 703-746-4800, option 6.

NOTE

The City Code requires that applicants who qualify for tax relief notify the Tax Relief Program in the event of any financial changes or the death of the applicant during the year that affects their eligibility status. Examples of changes that need to be reported include: (a) Change of residence; (b) Sale of the residential property in the City; (c) The death of the applicant(s); or (d) Changes in income or assets.

Changes in income, financial worth, ownership of the qualified property, or other factors occurring during the year for which tax relief is sought that affect the applicant’s eligibility status may adjust or eliminate any tax relief for the remainder of the tax year. Tax relief granted up to the date of any change that has affected the taxpayer’s eligibility for this program is not affected.

Further Information

Application assistance is available by phone or email at:

Tax Relief Program

703.746.4800, Option 6

Email: taxrelief@alexandriava.gov

In-Person Assistance available by appointment only at:

100 N Pitt ST, Suite 426, Alexandria, VA 22314 by calling 703.746.4800, Option 6

Walk-In Assistance available at:

4850 Mark Center Drive, 2nd Floor, Alexandria, VA 22311

8 AM – 5 PM, Monday through Friday