Stormwater Utility Fees and Credits for Residential Properties

Apply for the Stormwater Utility Fee Credit Program

From December 1st through February 15th, you can apply for credit towards your next two years of SWU fees! To learn more about the different practices that are eligible for a SWU fee credit, view the updated SWU Credit Manual.

To apply online for credits, please follow these steps:

1.) Go to the real estate assessment website here: Real Estate Assessment Search

2.) Type in your property details and click search.

3.) Click "Tax and Fee Info" button. This will take you to a new page.

4.) Scroll all the way to the bottom of the page. It will look like the below screenshot.

5.) Click "Apply for Stormwater Utility Credit" and fill out the application. Our team will be in correspondence with you to let you know the status of your application.

If paper forms are preferred they can be accessed here: Residential Property, Condo Associations, Non-residential property

For a list of native trees and plants, please review the following list: City of Alexandria Plant List

Certification Form to be completed by a qualified professional for structural BMPs & detention facilities

Want to learn more about best practices to maintain your BMP? Visit the Northern Virginia Regional Commission Stormwater BMP Guidebook: NVRC-Stormwater-BMP-Guidebook-Dec-2025

List of Contractors and Vendors for BMP Maintenance, Inspection, and Clean-Out Services: https://media.alexandriava.gov/docs-archives/tes/oeq/info/bmpmaintenancecontractorvendorlist=1=.pdf

Please send all questions and comments to Stormwater@alexandriava.gov.

Upcoming Webinars

Have more questions? Join one of our informational webinars.

Business focused webinar: February 4 from 10 a.m. to 11 a.m. This session is offered in collaboration with the Eco City Business Program. Join the Eco City Business Program’s upcoming webinar to learn how the City’s Stormwater Utility Fee Credit Program empowers businesses to manage stormwater, improve local water quality, and earn up to 50 percent off their SWU fee. This session is especially valuable for businesses looking to reduce costs while supporting sustainability goals.

Resident focused webinar: February 5 from 6 p.m. to 7 p.m. Hosted by the City of Alexandria’s Department of Transportation and Environmental Services, Stormwater Management Division, this session explains the purpose of the SWU Fee Credit Program, eligible practices to receive SWU fee credit, and how to apply for the SWU Fee Credit. The webinar includes a live Q&A session with stormwater staff to answer your questions about the SWU Fee Credit Program. Residents are encouraged to bring questions and learn how simple improvements can lead to real savings.

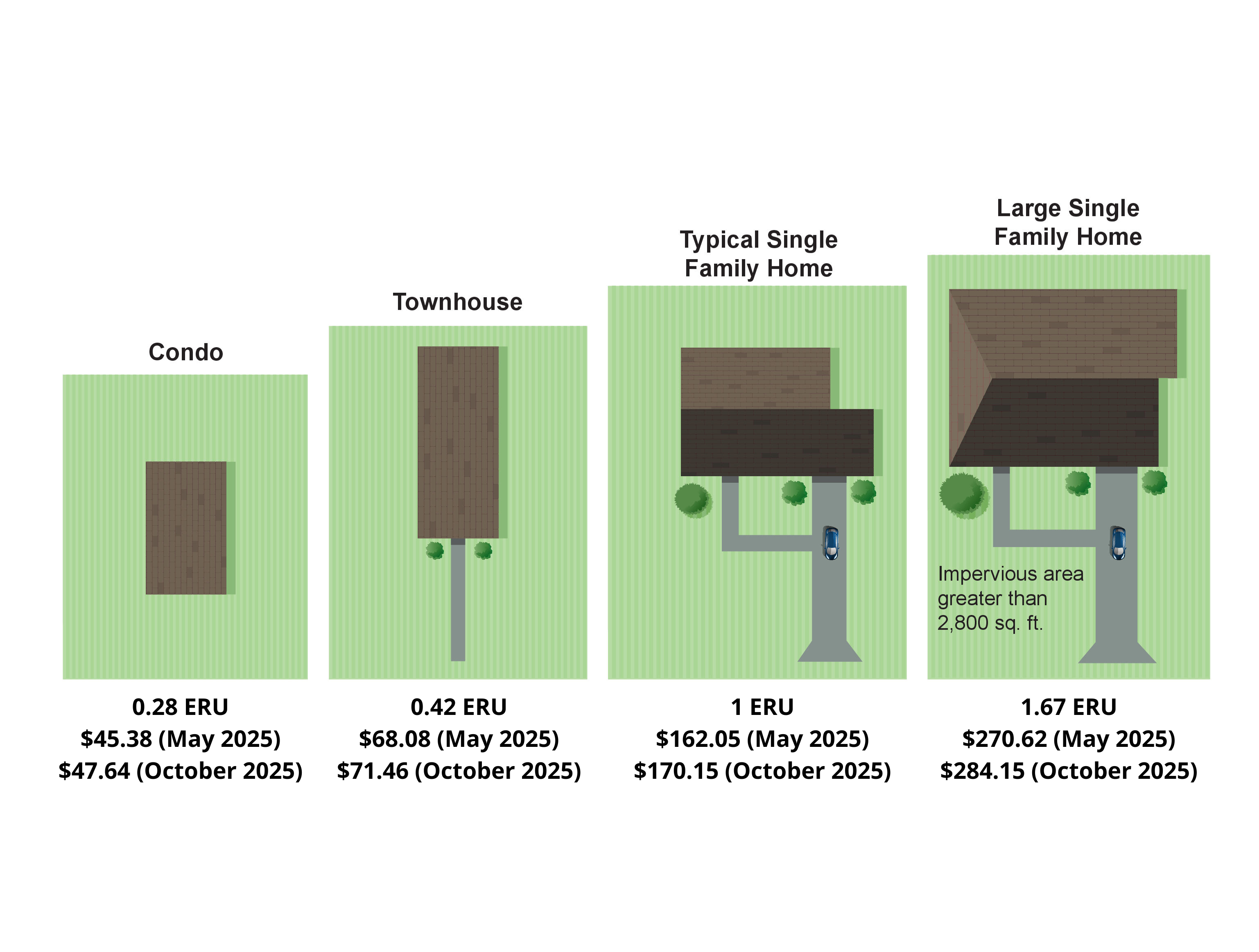

What is My Fee?

The Stormwater Utility Fee is billed to property owners as a separate line item on their real estate tax bills, half in May and half in October. Properties who do not pay tax receive a bill for just the Stormwater Utility fee. The fee is based on a property’s impervious area, or hard surfaces like roofs and driveways that don't let rain runoff soak into the ground.

To view the Stormwater Utility Fee for any property: use the property search or Stormwater Utility Fee Viewer and enter the property address.

Residential properties are billed using a tiered method that is based on the primary land use classification.

- Condo tier includes garden-style and hi-rise condos

- Townhouse tier includes townhouse-style condos, row townhouses, and semi-detached houses

- Typical and large single-family tiers include detached houses

The stormwater utility fee has increased to accelerate capital stormwater projects and maintenance to mitigate flooding impacts from more intense rainfall events that have occurred over the last three years. City Council voted on an increase for FY22 via revision to the ordinance at the Jan. 26, 2021, Legislative Session and adopted on second reading at the Feb. 20, 2021 Public Hearing. The City Manager proposed a 5% increase to the SWU fee for FY23 that was adopted on May 4, 2022. For FY24, an increase of 5% was proposed by the City Manager and adopted by Council on May 3, 2023. For FY25, an increase of 5% was proposed by the City Manager and adopted by Council on May 1, 2024. For FY26, an increase of 5% was proposed by the City Manager and adopted by Council on April 30, 2025. The stormwater utility is billed twice a year in May and October and each billing is based on half (½) the billing rate. The October 2025 billing rate will be $340.30 and billed at $170.15 (half of $340.30).

What services does the Stormwater Utility Fee fund?

How Do I Pay?

Most customers receive the bill as a line item on their real estate tax bill that is received directly or through their mortgage company in May and October each year. Properties who do not pay real estate tax, receive a bill for just the stormwater utility fee. Contact the Finance department for assistance or to pay a bill.

Latest Updates on SWU Credits

On November 9th, 2022, the City Council approved the latest Stormwater Utility Credit Manual. The manual provides a menu of credit options per property type. Please read through your property type menu to see what current and new credits are available for you to implement and apply for during the credit application window which starts December 1st and ends February 15th.

Residential Credit Menu

Combine eligible credits can reduce fees by up to 50 percent! Check out Section 6 of the Stormwater Utility Fee Credit Manual for more information on each practice for residential properties.

Condo Association Credit Menu

Combine eligible credits can reduce fees by up to 50 percent! Check out Section 7 of the Stormwater Utility Fee Credit Manual for more information on each practice for condo association properties. A condo association must apply on behalf of the property owners if the applicable credit affects more than one property. For instance, the stormwater detention pond is maintained yearly and some of the property drains to the practice, then all property owners in the association could receive a credit. For one condo owner who installs a floodgate at their front door, the condo owner would need to apply for the credit since it only affects their property. Please see the manual for example calculations.

How Do I Appeal my SWU Fee?

You may request an adjustment to the fee if there is an error on your bill. Appeal application window is from May 15th to June 15th.

Pay your stormwater utility fee even if you’ve submitted an appeal, because payments are applied first to fees, then to any prior period outstanding balance. This may cause late payment penalty and interest to the assessed on the current tax and fees, if the total due is not paid by the respective due date of the real estate property tax bill.

Once you’ve submitted an appeal, the City will review and make a determination upon the receipt of a complete application, including any additional information requested by the City. If a petition to adjust your fee is approved, you will receive a revised bill or payment credit. There are two ways to apply for a appeal.

- Submit an appeal through the Real Estate Website.

- Download the printable appeal form.

If you have any questions, please contact Stormwater@alexandriava.gov

Contacts

Stormwater@alexandriava.gov