FY 26 Budget Q&A #082: Is it possible to double the new short-term rental permit fee, and would that generate an additional $185,000 in revenue? What potential impacts could this have on attracting tourists to Alexandria and the local housing market?

Question: Is it possible to double the new short-term rental permit fee, and would that generate an additional $185,000 in revenue? What potential impacts could this have on attracting tourists to Alexandria as well as on the local housing market? (Councilman Elnoubi)

Response:

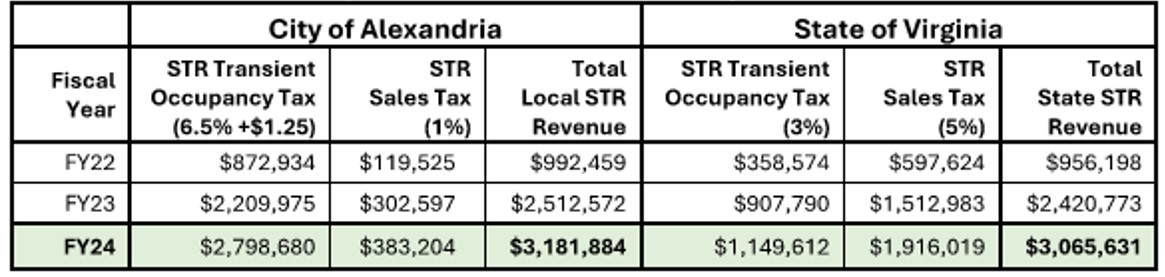

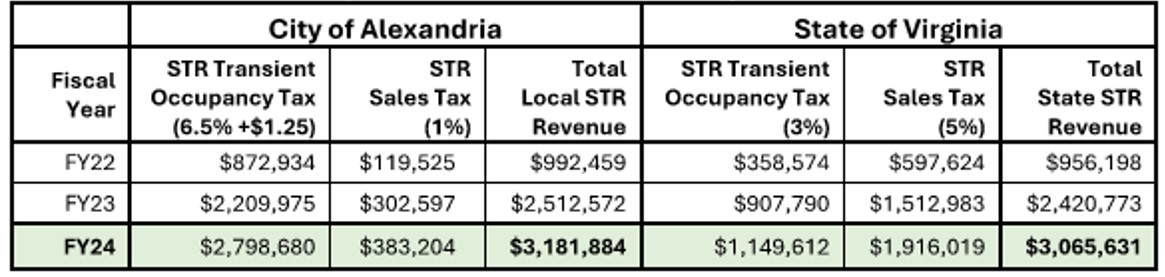

Short-term rentals generate approximately $3.2 million in tax revenue for the City of Alexandria and $3.1 million for the State of Virginia. This represents 25% of Transient Occupancy Taxes (TOT) generated in the city.

In other jurisdictions where short-term rental regulations and permits are established, they have seen the total number of short-term rentals decrease by 10%-30%, depending upon how stringent new regulations are and the cost of the permit. While it is possible to double the proposed short-term rental permit fees (currently proposed to be $350 for owner-unoccupied STRs and $100 for owner occupied properties); operators have expressed displeasure for the proposed fees as they are higher than neighboring jurisdictions. Doubling fees would put Alexandria well above other local jurisdictions and well beyond the typical $200-$500 fee other jurisdictions around Virginia and the U.S. charge.

Arlington County: $63 annually

Fairfax County: $235 every two years

Washington DC: $104.50 every two years

A $700 annual permit fee could also have unintended consequences including 1) substantially driving down the number of short-term rentals thus impacting TOT and sales tax revenue, and 2) high fees could lead to non-compliance with permit requirements creating additional work for enforcement staff.

Given the city receives $3.2 million in tax revenue from short-term rentals, staff has proposed a permit fee that covers the cost of administration only.