FY 25 Budget Q&A #081: Can you provide any insight into why the state maximum is higher for BPOL on Financial Services and why we have not raised that rate to reflect that allowance? How many businesses do we have registered in the category in Alexandria?

Question: Can you provide any insight into why the state maximum is higher for BPOL on Financial Services and why we have not raised that rate in the past to reflect that allowance? How many businesses do we have registered in the category in Alexandria? (Councilmember Sarah Bagley)

Response:

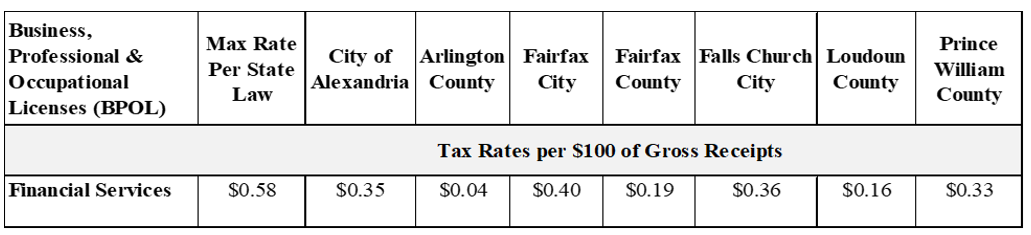

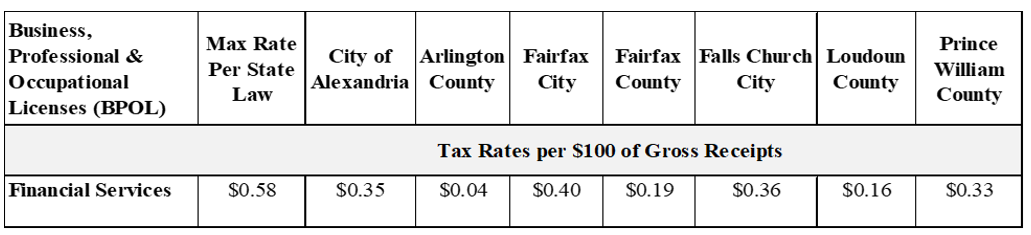

At $0.35 per $100 of gross receipts, the City has the second-highest BPOL rate for Financial Services among Northern Virginia localities. No localities are at the State maximum.

For Tax Year 2023, the City issued 216 business licenses under the Financial Services category. For FY 2025, this category is estimated to yield approximately $3.56 million in BPOL tax revenue. While the average tax bill is approximately $16,493, the range is significant. The top quartile pays an average of $66,130.

The value of one penny on the tax rate for this category is approximately $101,787. Taking this category up to the State maximum is estimated to generate an additional $2.3 million in tax. This would increase the average tax to $28,113. The average for the top quartile would increase to $109,587.