FY 25 Budget Q&A #082: What would be the financial impact of increasing the vehicle personal property tax relief assessed value limit from the current $20,000 to $30,000 or the state cap of $52,000?

Question: What would be the financial impact of increasing the vehicle personal property tax relief assessed value limit from the current $20,000 to $30,000 or the state cap of $52,000? (Mayor Justin Wilson)

Response:

Under the present program, the Elderly (65 and over) or permanently and totally disabled (no age restriction) can get tax relief on their car as long as their gross income does not exceed $20,000 and their net assets do not exceed $75,000. The relief is only granted to one vehicle per household, assessed less than $30,000. Section 58.1-3506.2 of the Code of Virginia sets the maximum gross income limit for the City’s program at $52,000, or according to annually published HUD limits based on family size.

In FY 2024, relief was granted to 70 applicants, reducing General Fund revenue by $32,123, or average relief of $459 per person.

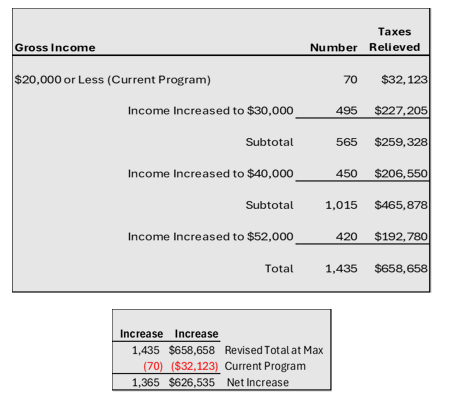

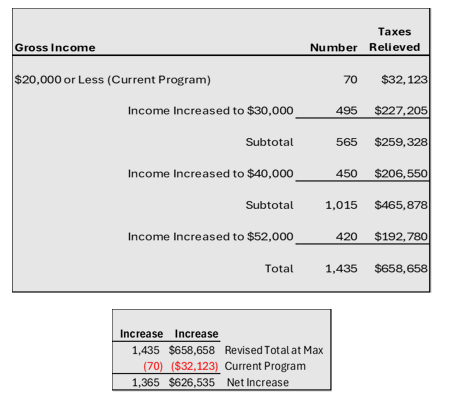

Extrapolating from American Community Survey data (Census), it can be roughly estimated that raising the gross income limit could further reduce General Fund revenue as follows: