FY 25 Budget Q&A #050: What is the financial impact of the adopted state budget on the City and schools?

Question: What is the financial impact of the adopted state budget on the City and schools? (Mayor Justin Wilson)

Response:

The biennial budget for the Commonwealth (HB 30) includes numerous items of interest and impact to localities across Virginia, including the City of Alexandria. The budget is currently before the Governor for his consideration, with a deadline of April 8 for his action.

A comprehensive accounting of these items was provided by the Virginia Association of Counties and is attached. Some items of particular interest and impact to the City include:.

WMATA Funding

Provides $65 million in FY 2025 and $84.5 million in FY 2026 for WMATA; suspends the statutory cap on growth in the annual Virginia operating assistance for WMATA; directs WMATA to complete a comparison of its total costs and overhead costs against the cost of similar transit systems. (Item 433 #2c)

Provides $25,000 in FY 2025 for a legislative joint subcommittee to study long-term, sustainable, dedicated funding and cost-containment controls and strategies to ensure WMATA and other Northern Virginia transit systems meet the growing needs of public transit in the region. (Item 1 #6c)

Resilience and Climate Change

Retains $100 million in FY 2025 in the introduced budget for the Community Flood Preparedness Fund.

Eliminates the additional $25 million in FY 2025 for the Resilient Virginia Revolving Loan Fund proposed in the introduced budget. (Item 359 #2c)

Provides $10 million in FY 2025 to establish the Virginia Clean Energy Innovation Bank to finance climate initiatives. (Item 471 #3c)

Requires the Commonwealth to rejoin the Regional Greenhouse Gas Initiative (RGGI). (Item 381 #1c – (caboose) and Item 366 #1c)

Compensation Increases for K-12 Instructional and Support Positions

The Governor had proposed the state’s share of a 1 percent bonus payment, effective July 1, 2024, and the state’s share of a 2 percent salary increase, effective July 1, 2025. The conference report instead provides for the state’s share of a 3 percent salary increase in each year for SOQ-recognized instructional and support positions, effective July 1, 2024, and July 1, 2025. A local match is required.

The state’s share will be pro-rated for divisions providing less than an average 3 percent increase, but in order to draw down the state funds, school divisions must provide at least an average 1.5 percent increase in the first year, and at least an additional average 1.5 percent increase in the second year. School divisions providing an average increase of more than 3 percent in the first year can credit the excess portion of the increase toward the second year. (Item 125 #11c, Item 125 #15c)

Compensation Increases for State-Supported Local Employees

The Governor had proposed a 1 percent bonus payment on December 1, 2024, a 1 percent salary increase on July 1, 2025, and another 1 percent bonus payment on December 1, 2025. The conference report instead provides for a 3 percent salary increase in each year of the biennium, effective July 1, 2024, and July 1, 2025. (Item 469 #2c)

HB 30 includes language providing for a one-time bonus payment of 1.375 percent on December 1, 2025, for state and state-supported local employees, if the legislation increasing the minimum wage does not take effect. (If the legislation does take effect, this amendment provides funding for the Compensation Board to address impacts of the minimum wage increase on Constitutional offices, as well as funding for rate increases for certain Medicaid providers.) (Item 469 #6c)

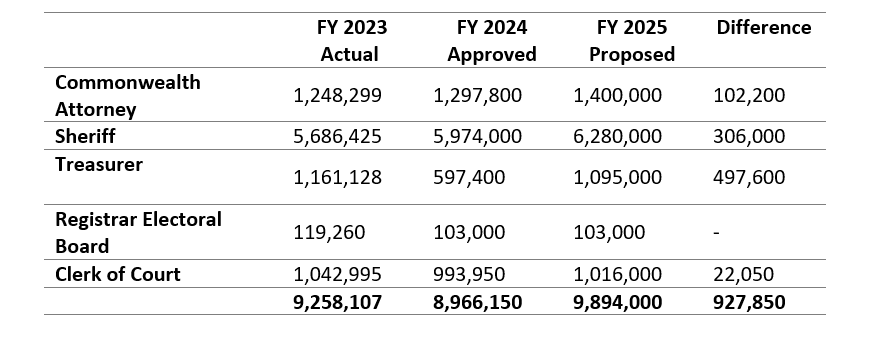

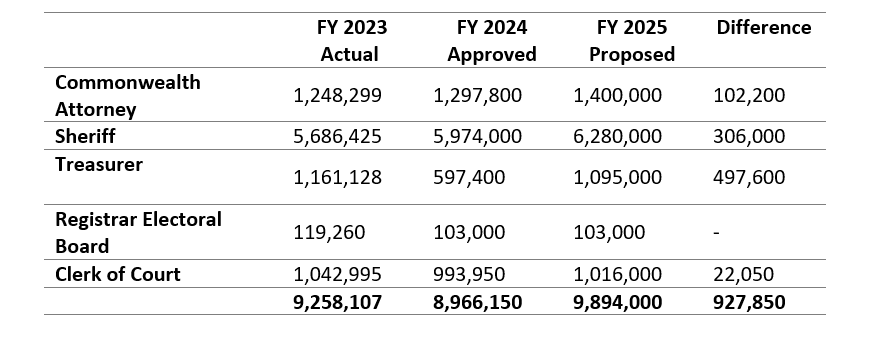

Listed below are the State compensation board payments included in the FY25 Proposed Budget. These amounts have been increased beyond the City’s FY 2025 proposed amount in the State budget. Those increases will be reflected in the FY 2025 March revenue re-estimate.

Restoration of “Hold-Harmless” Funding Related to the Elimination of State Portion of Grocery Tax

When the state portion of the sales and use tax on groceries was eliminated in 2022, statutory language required funding to be provided to compensate school divisions for the lost revenue associated with the elimination of the portion of the grocery tax that was distributed to school divisions based on school-age population. The Governor’s introduced budget failed to include this funding; the compromise budget as reflected in the conference report includes $243 million over the biennium to restore the hold-harmless payments. (Item 125 #10c)

At-Risk Add-On Funding

HB 30 provides $186.7 million in FY 2025 and $184.6 million in FY 2026 to consolidate the SOQ Prevention, Intervention, and Remediation and At-Risk Add-On programs into one At-Risk Add-On program; use federal Identified Student Percentage rates rather than federal free-lunch rates to estimate the number of At-Risk students (with a multiplier of 1.25, plus one-quarter of English learner students); distribute an 11 percent basic aid add-on per estimated at-risk student; and provide an add-on percentage ranging from 0 to 37 percent, depending on each school division’s relative concentration of at-risk students. This amendment is derived from JLARC’s K-12 funding study. (Item 125 #2c)

Support for English Language Learners

Provides $37.9 million in FY 2025 and $34.2 million in FY 2026 for the state’s share of additional English Learner teachers, based on student proficiency. Language allows for staffing in the first year to equate to the number of teachers required during the 2023-2024 school year, plus one-half of the additional positions that would otherwise be required. (Item 125 #3c)

State Aid to Localities with Police Departments (“HB 599”)

Provides an increase of $10 million per year for the HB 599 program. (Item 396 #1c)

Gun Violence Prevention Funding

Reduces funding for the Operation Ceasefire Grant Fund by $7.5 million per year (leaving $10 million per year available for use); bars funding from being provided to state agencies and bars grant funding for law enforcement equipment, with the exception of forensic and analytical equipment. (Item 394 #6c, Item 394 #5c)

Funding to Support Crime Victims and Witnesses

Retains the additional $7.2 million over the biennium provided for the Victim-Witness Grant Program in the introduced budget and provides an additional $1.3 million per year. (Item 394 #15c) Retains the additional $3.5 million in FY 2026 provided for sexual assault crisis centers and domestic violence programs in the introduced budget and provides an additional $2.1 million per year to return grantees to FY 2023 levels. (Item 394 #16c). Provides $1.5 million in FY 2025 and $2.5 million in FY 2026 for the Victim Services Grant Program to offset expected declines in federal funding. (Item 394 #17c)

Grants to Combat Hate Crimes

Retains the additional $2 million in FY 2025 proposed in the introduced budget for grants to combat hate crimes; adds language directing DCJS to disseminate information to stakeholders about the grant opportunity and allowing localities in partnerships with institutions or nonprofits that have been targets of hate crimes, or are at risk of being targets, to be eligible to apply (the introduced budget language limited eligibility to these institutions or nonprofits). (Item 394 #19c)

Affordable Housing

Deposits an additional $12.5 million per year to the Virginia Housing Trust Fund (the introduced budget level funds the Trust Fund at $75 million per year). (Item 102 #3c)

Childcare

Retains actions in the introduced budget to maintain Child Care Subsidy and Mixed Delivery slots after the expiration of federal funding. Provides an additional $116.7 million over the biennium beyond amounts in the introduced budget to maintain co-pay rates for the Child Care Subsidy Program and apply these rates to the Mixed Delivery Program; fund additional Child Care Subsidy Program slots; restore the traditional 20 percent nonparticipation rate for the Virginia Preschool Initiative; and maintain the 0.5000 cap on the Local Composite Index for the Virginia Preschool Initiative, for a total increase of $527.8 million in General Fund dollars over the biennium. Consolidates all early childhood programs into one Early Childhood Care and Education section in the budget. (Item 117 #5c; Item 124 #4c; Item 125 #21c, Item 125.10 #1c)

Aid to Local Public Libraries

Provides an additional $2.5 million per year to increase state aid to local public libraries, which would result in an additional $66,346 for Alexandria’s libraries. (Item 227 #1c)

Tax Policy

Increases the individual taxpayer cap on the Historic Rehabilitation Tax Credit from $5 million to $7.5 million. (Item 3-5.17 #1c)

Eliminates proposed increase to the Earned Income Tax Credit. (Item 4-14 #1c)

Attachments

Attachment 1- Analysis of Conference Report