FY 25 Budget Q&A #027: When was the last time the City used General Obligation Bonds to finance affordable housing? What would be the size of the bond issuance needed to fully fund Parcview II and Community Lodgings?

Question: When was the last time the City used General Obligation Bonds to finance affordable housing? What would be the size of the bond issuance needed to fully fund Parcview II and Community Lodgings? (Councilwoman Alyia Gaskins)

Response:

Previous Borrowing for Affordable Housing

In 2017 the City used borrowing for The Bloom at Braddock Project, a collaboration between nonprofits, Housing Alexandria (HALX) and Carpenter’s Shelter, that delivered a purpose-built shelter for persons experiencing homelessness and 97 affordable rental units, including ten dedicated as permanent supportive housing. The structure of this affordable housing project required the use of taxable bonds, which typically incur a higher interest rate than the rates experienced in a typical general obligation (GO) issuance for a AAA/Aaa-rated jurisdiction. The 2017 bond issuance totaled $4.38 million. Debt service on this issuance, along with other prior affordable-housing related borrowing, totals $1.5 million in FY 2025.

Timing of Affordable Housing Projects

The Parcview II and Community Lodgings, Incorporated (CLI) Elbert Avenue projects are currently forecasted to receive funding in FY 2030, at the earliest, based upon the pipeline of approved and in-progress projects in which City has already committed dedicated housing funds for the next few years. City affordable housing funding is currently committed to the following projects between now and FY 2030:

- Sanse & Naja (Arlandria Mount Vernon Avenue & Glebe Road)

- Seminary Road – Homeownership/ Sheltered Homes of Alexandria

- Witter Place

- Samuel Madden Redevelopment

- 1022 Pendleton Street Rooming House

- Arlandria Chirilagua Housing Cooperative (ACHC)

Additionally, there are several other affordable housing projects currently under consideration, that are competing for the commitment of City dollars, including Landmark Fire Station – Affordable Housing. View the current Affordable Housing ‘Pipeline’ Chart at the bottom of this response, for details on all affordable housing projects currently under consideration.

Financing of Future Projects

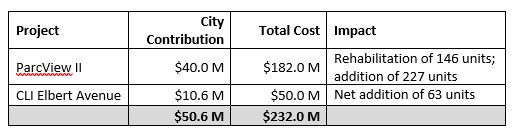

The current estimated City contributions required for the Parcview II and CLI Elbert Avenue projects is $50.6 million.

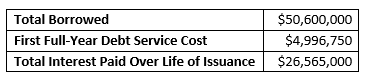

Similar to The Bloom at Braddock Project, it is anticipated that if the City were to finance its contributions to the ParcView II and CLI Elbert projects, it would require the use of the taxable bonds. Based on current market conditions, it is estimated that the interest rate for taxable bonds for a AAA/Aaa-rated jurisdiction would range from 4.5%-5.5%. For modeling purposes, this estimate assumes 5.0%. Borrowing $50.6 million for these affordable housing projects would result in a first full-year debt service cost of approximately $5.0 million. This debt service impact would require identification of new funding sources or revenue, as current dedicated affordable housing funds have been committed to upcoming affordable housing projects (described above), are used to support on-going operating budget initiatives and programs within the Office of Housing, or are servicing previously issued debt for affordable housing projects.

Impacts on Debt Management Policies

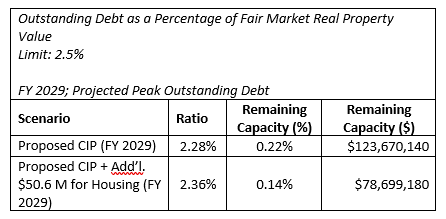

Affordable Housing associated borrowing is not exempted from the City’s self-adopted debt management policies. The addition of $50.6 million of borrowing will result in further pressure on the City’s debt limits. In the Proposed FY 2025 – FY 2034 CIP, outstanding debt applicable to the ‘Outstanding Debt as a Percentage of Fair Market Real Property Value’ ratio is projected to peak at 2.28% (relative to the policy limit of 2.5%) in FY 2029. Adding the $50.6 million in affordable housing borrowing will increase this ratio to 2.36%.