FY 25 Budget Q&A #017: What tax rate increase would be required to fully fund the School board adopted operating budget and CIP?

Question: What tax rate increase would be required to fully fund the School board adopted operating budget and CIP?

Response:

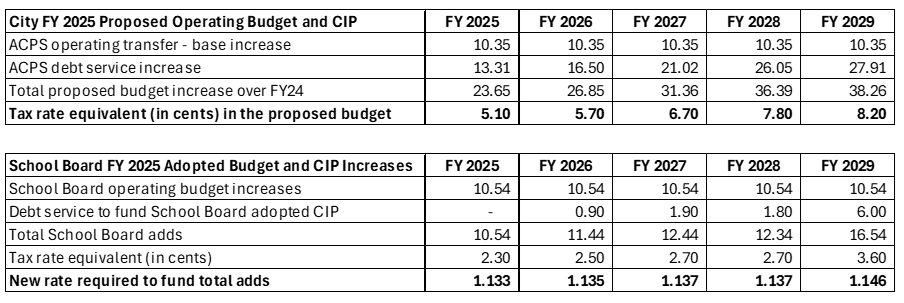

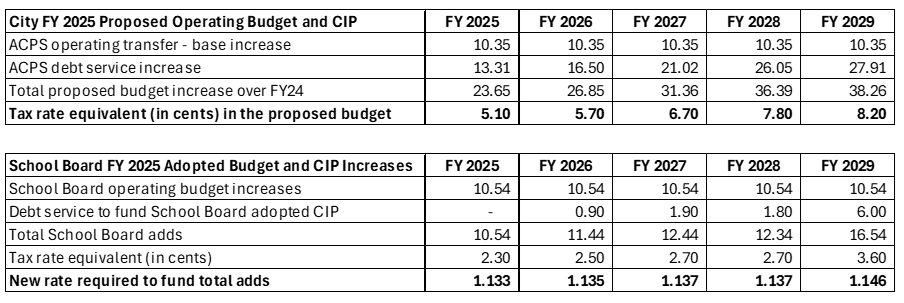

The City Manager’s FY 2025 proposed budget includes a $10.3 million increase in the ACPS operating transfer as proposed by the Superintendent and a $13.3 million increase in school CIP debt service for a $23.6 million combined increase which equates to 5.0 cents on the real estate tax rate that was funded within the existing rate.

The School Board’s additions to the Superintendent’s proposed operating budget total $10.537 million. At $4.7 million per 1 cent on the real estate tax rate, an increase of 2.3 cents would be required to fully fund the School Board adopted operating budget.

The difference between the City proposed CIP and the School Board adopted CIP is $65 million, including $20 million in FY 2025 for George Mason Elementary School and $45 million in FY 2028 and FY 2029 for Cora Kelly Elementary School. The additional debt service beyond what is currently funded in the City FY 2025 proposed operating budget would be approximately $0.9 million in FY 2026, $1.9 million in FY 2027, $1.8 million in FY 2028, and $6.0 million in FY 2029.

Combined, the real estate tax rate increases needed to fully fund the ACPS adopted operating budget and CIP would be 2.3 cents in FY 2025, an additional 0.2 cents in FY 2026 and FY 2027, and 0.9 cents in FY 2029 for a total increase of 3.6 cents over five years in present dollars. This includes no assumptions about assessment growth or inflation.

These are only the tax rate increases needed to fully fund the ACPS operating budget and CIP in FY 2025. Future City government or ACPS needs could require additional rate increases, such as debt service increases necessary to fund the currently proposed CIP, collective bargaining for ACPS or other City employee groups, middle school capacity needs, or changes in state funding for schools. The City’s five-year revenue and expenditure forecast for FY 2026 through FY 2029 based on the FY 2025 operating budget and planned cash capital and debt service for City and Schools projects funded in the City proposed CIP includes a budget shortfall that would grow to $54.3 million by FY 2029 if not addressed through tax increases and/or service reductions. The forecast does not include pending legislation in the General Assembly for potential additional teacher pay increases.

As a reminder, the City Manager’s recommendation on how to spend an additional 1 cent on the real estate tax rate included $3.4 million for CIP funding to reduce the impact of debt service on the FY 2026 operating budget, $1.0 million for targeted compensation increases resulting from cyclical position classification reviews, $165,000 for youth safety and resilience initiatives, and $100,000 for a Sheriff’s deputy.