FY 25 Budget Q&A #011: Are there taxes or fees charged by our comparator jurisdictions on short term rental units (Air BnBs, etc) that we do not levy in Alexandria?

Question: Are there taxes or fees charged by our comparator jurisdictions on short term rental units (Air BnBs, etc) that we do not levy in Alexandria? (Councilman R. Kirk McPike)

Response:

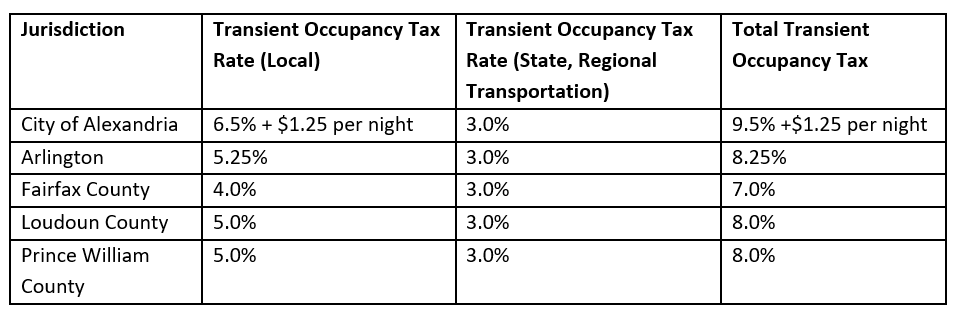

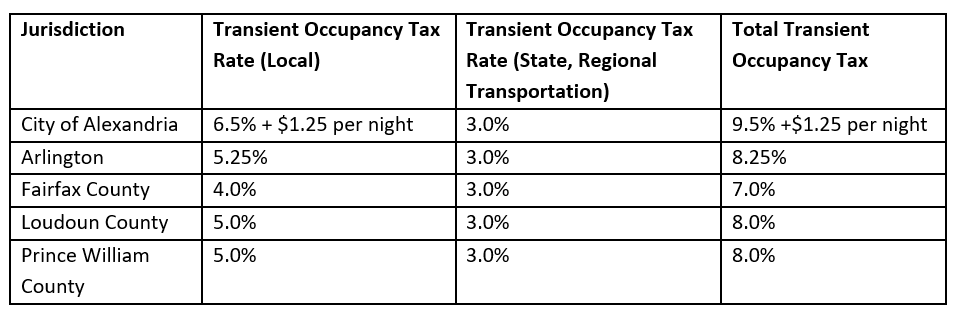

All leases and rentals of tangible personal property in Virginia are subject to Virginia sales tax unless an exemption or exception is established. All Northern Virginia jurisdictions have a 6 percent Sales Tax rate (1% Local Sales Tax, and 5% State Sales Tax) but each jurisdiction’s transient occupancy tax rate may differ.

Business, Professional, and Occupational Licenses (BPOL) may be charged on the rentals, but only if the operator rents more than four residential properties. In the City of Alexandria, short-term rental properties do not require zoning or permitting approvals, but any normal zoning or permitting provisions would still apply. All of the above-listed Northern Virginia jurisdictions regulate short-term rentals through their zoning ordinances. All of the above-listed Northern Virginia jurisdictions regulate short-term rentals through their zoning ordinances. In response to a City Council request, staff will be adding a short-term rental study to the 2024 work program and is working on a memorandum to Council outlining the study's parameters.