FY 25 Budget Q&A #008: How does Alexandria's property tax relief program for seniors with limited resources compare to those of neighboring jurisdictions? What would it cost to increase the asset limit by 10%? 25%? 50%?

Question: How does Alexandria's property tax relief program for seniors with limited resources compare to those of neighboring jurisdictions? What would it cost to increase the asset limit by 10%? 25%? 50%? What would it cost to increase the household gross combined income maximum limit from $40,000? (Councilman R. Kirk McPike, Councilmember Sarah Bagley)

Response:

Gross Income Changes:

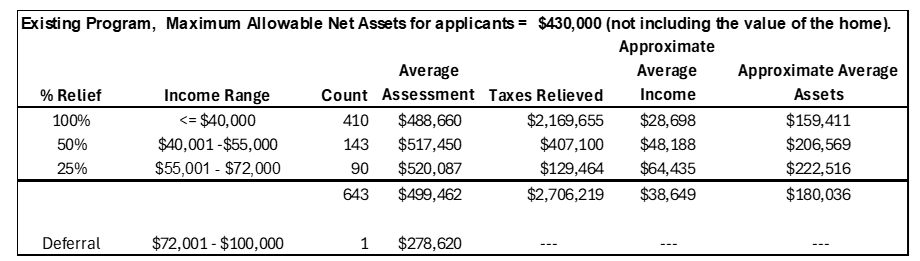

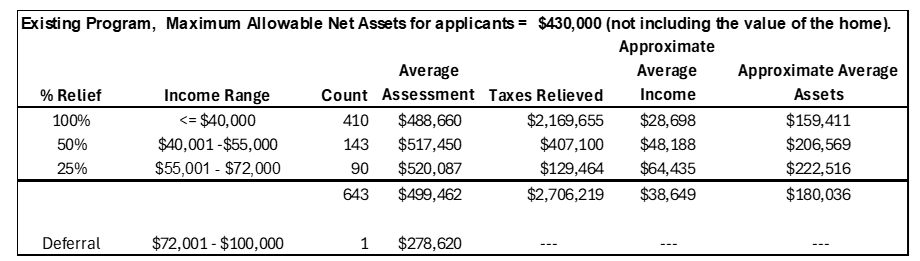

Based on Tax Year 2023 data, the following table presents the current array of Tax Relief for the Elderly and Disabled (excludes relief provided to Disabled Veterans). The existing program provides graduated tax relief for incomes up to $72,000:

The fiscal impact of raising the income limit depends on the amount of increase and the percentage of relief Council desires to provide. Two possible income scenarios are presented below and are roughly estimated based on an extrapolation from Census data. Other scenarios can likewise be considered.

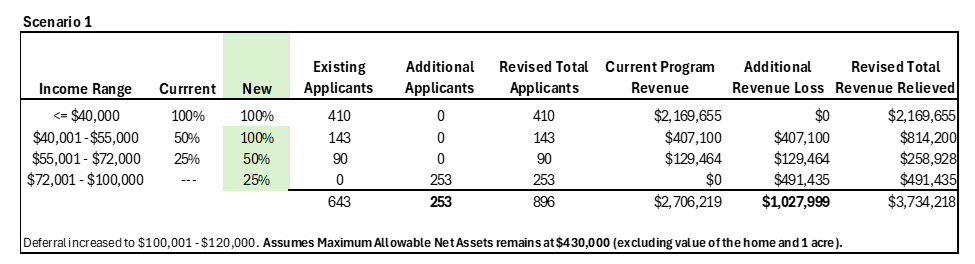

Scenario 1: Extend graduated tax relief for incomes up to $100,000

If Council raises the income limit for 100% relief from $40,000 to $55,000, it is roughly estimated that this would reduce FY 2025 General Fund revenue by approximately $407,100.

If new income ranges are also established for relief at 50% and 25%, it is similarly estimated this would reduce revenue by another $620,899. The combined impact is estimated to be approximately $1.03 million in additional lost revenue in FY 2025. Scenario 1 is estimated to add approximately 253 applicants to the program, and is summarized below:

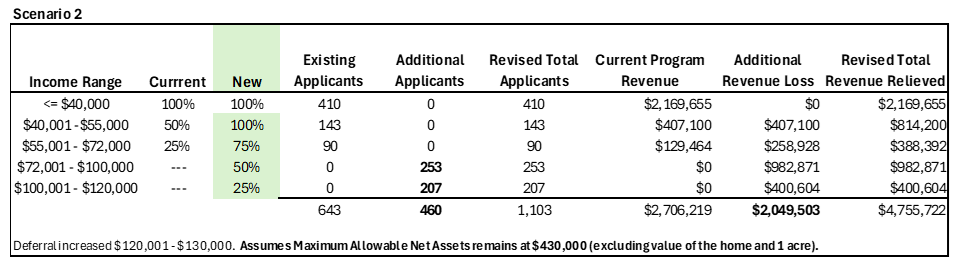

Scenario 2: Extend graduated tax relief for incomes up to $120,000

As in Scenario 1, the second scenario raises the maximum income threshold for 100% relief from $40,000 to $55,000, but relief would be set at 75% for incomes ranging from $55,001 - $72,000; and 50% for incomes at $72,001 - $100,000; and 25% for incomes from $100,001 - $120,000. It is roughly estimated that the combined impact would be approximately $2.05 million in additional lost revenue in FY 2025. Scenario 2 is estimated to add approximately 460 applicants to the program and is summarized below:

Net Asset (Net Worth) Changes:

As shown below, the City’s allowable net assets are reasonably close to those of our neighboring jurisdictions. Unfortunately, staff has minimal data from which to calculate a reasonable estimate of the impact of changing net assets for the Tax Relief program.

According to the Federal Reserve in a report dated October 2023, the median net worth of persons 65 and older ranged in 2022 from $335,600 to $409,900, however, the average ranged from $1.6 million to $1.8 million. For all homeowners regardless of age, the median was $396,200, with an average net worth of $1.5 million. However, this is national data only.

On March 18, 2024, staff received tax relief data from Loudoun County that assists with a rough estimation of net assets for the City’s program. Loudoun has approximately 88 applicants with income less than $70,000 and net assets between $430,000.01 - $560,000.

If you assume the City has a comparable number as Loudoun, adjusting for our relative population size, that would suggest we have approximately 31 senior owners with the same level of net assets. Using the existing program income thresholds, a comparable increase in net assets would result in an additional loss of about $190,000.

While this estimate appears to offer a reasonable order of magnitude, it does assume that net asset characteristics in the City mirror those in Loudoun County.

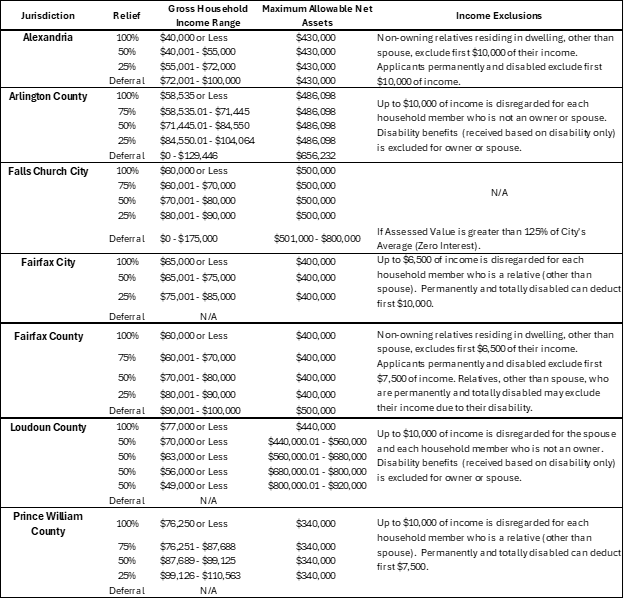

Survey of Tax Relief Thresholds in Other Northern Virginia Jurisdictions: