FY 25 Budget Q&A #007: What amount of revenue would be created by raising the hotel occupancy tax rate by 1%? Were any revenue enhancements other than a property tax rate increase (fee increases, etc) considered by Staff?

Page updated on December 26, 2024 at 9:35 AM

XWARNING: You have chosen to translate this page using an automated translation system.

This translation has not been reviewed by the City of Alexandria and may contain errors.

Question: What amount of revenue would be created by raising the hotel occupancy tax rate by 1%? Were any revenue enhancements other than a property tax rate increase (fee increases, etc) considered by Staff as this budget was being developed that were not included in the Manager's proposed budget? (Councilman R. Kirk McPike)

Response:

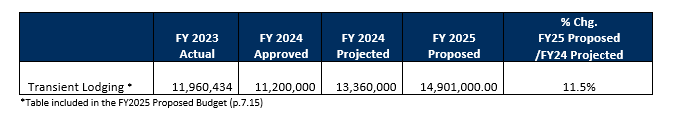

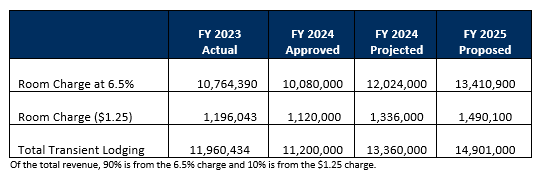

The transient lodging tax rate was last increased in FY 2019 from 6.5 percent of the room charge and $1.00 per room per night to 6.5 percent of the room charge and $1.25 per room per night. In FY 2023, the City collected $12.0 million in transient lodging revenue from both sources and is projected to collect $13.4 million in FY 2024. Based on the FY 2023 revenue, raising the local base tax rate to 7.5 percent would generate $2.0 in additional revenue. There is no State limit on transient lodging tax for cities and the FY 2025 proposed budget recommends no change to this rate. There were no revenue enhancements other than property tax increases suggested by staff.