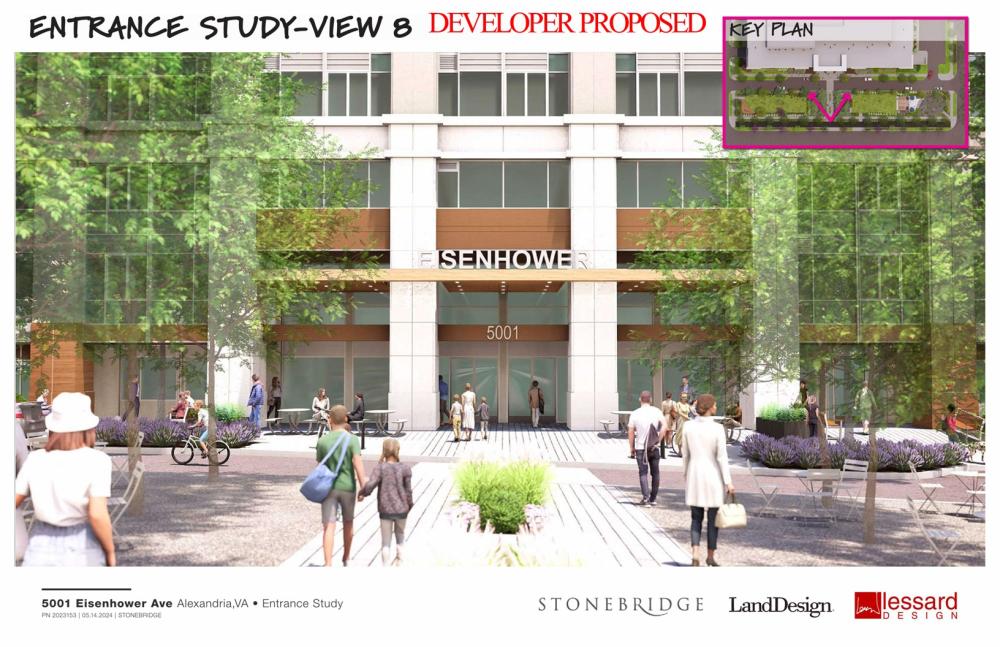

5001 Eisenhower Avenue Office Building Conversion Project

Public Presentation of Proposal

Preliminary Development Details

This summary outlines the key terms, objectives, and agreements proposed between the City of Alexandria and Stonebridge Associates, Inc. regarding 5001 Eisenhower Avenue.

Project Overview

Main Components

- Conversion of Existing Office Building

- Conversion of the now-vacant and existing office building for 377+/- rent-controlled housing units including affordable and workforce housing units

- Includes a City-operated community space

- Future Development

- Construction of 450+/- new market-rate dwelling units

- Includes associated open spaces, day care space, and retail space on the remainder of the site

- Construction of 450+/- new market-rate dwelling units

Conversion Building Details

- Financial Overview

- Construction improvements cost: $105 million+/-

- Estimated total development budget: $150 million+/-

- Rent-Controlled Unit Commitments

- 377+/- dwelling units rented at affordable and workforce rates for 40 years:

- Affordable Units:

- 41 units at 50% AMI – exclusively available to income-qualified residents

- These units shall contain:

- 20 junior 1 bedroom, 1 bathroom units

- 20 2 bedroom, 2 bathroom (1 interior bedroom) units

- 1 2 bedroom, 2 bathroom, plus den (1 interior bedroom and den) unit

- These units shall contain:

- 41 units at 60% AMI – exclusively available to income-qualified residents

- These units shall contain:

- 20 junior 1 bedroom, 1 bathroom units

- 20 2 bedroom, 2 bathroom (1 interior bedroom) units

- 1 2 bedroom, 2 bathroom, plus den (1 interior bedroom and den) unit

- These units shall contain:

- 41 units at 50% AMI – exclusively available to income-qualified residents

- Workforce Units:

- 189 units at 80% AMI

- 106 units at 100% AMI

- Affordable Units:

- The 80% and 100% AMI units will be available to income-qualified residents for 75 days after each unit is vacated and may be leased at the restricted rent to tenants whose incomes are higher after 75 days

- The City’s Office of Housing will enforce its standard conditions, ensuring rent-controlled units are leased in accordance with City policies

- The City’s financial participation described below (partial real estate tax abatement) will be terminated if rent-control requirements are not met

- Remedies after the abatement period if rent-control requirements are not met

- 377+/- dwelling units rented at affordable and workforce rates for 40 years:

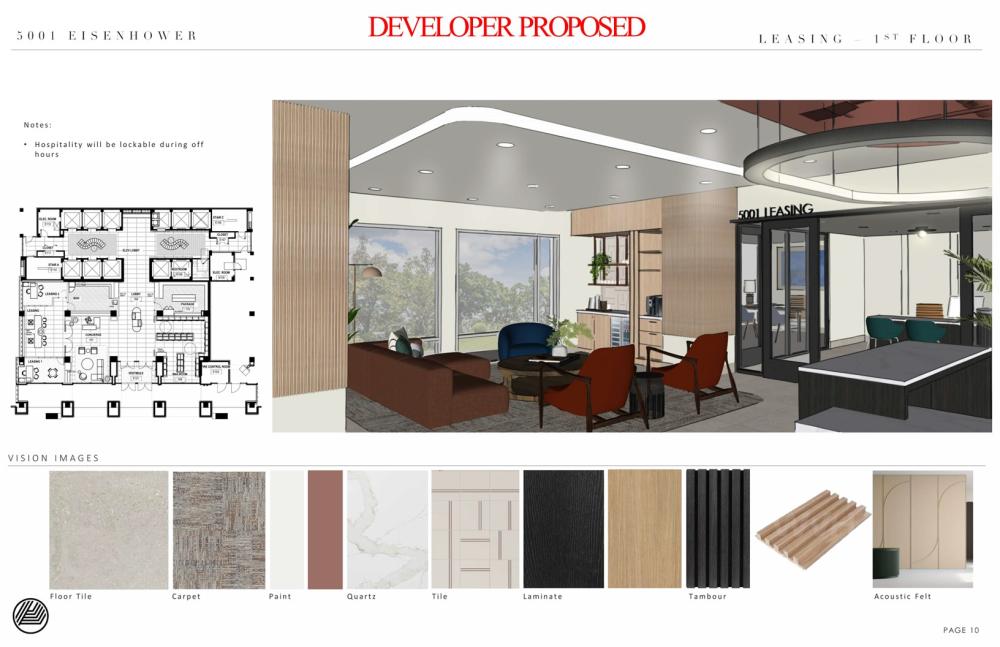

- City Space Provision

- The Developer will construct a 2,000+/- sq. ft. community space for City use at no cost to the City, which will be initially built out to a “warm lit shell” condition

- Space to be leased to the City for $1/year for 40 years

- The Developer will provide the City with an additional $50,000 allowance to complete build-out when a user is identified. The City will work with Developer to finalize plans for the City Space by June 30, 2025

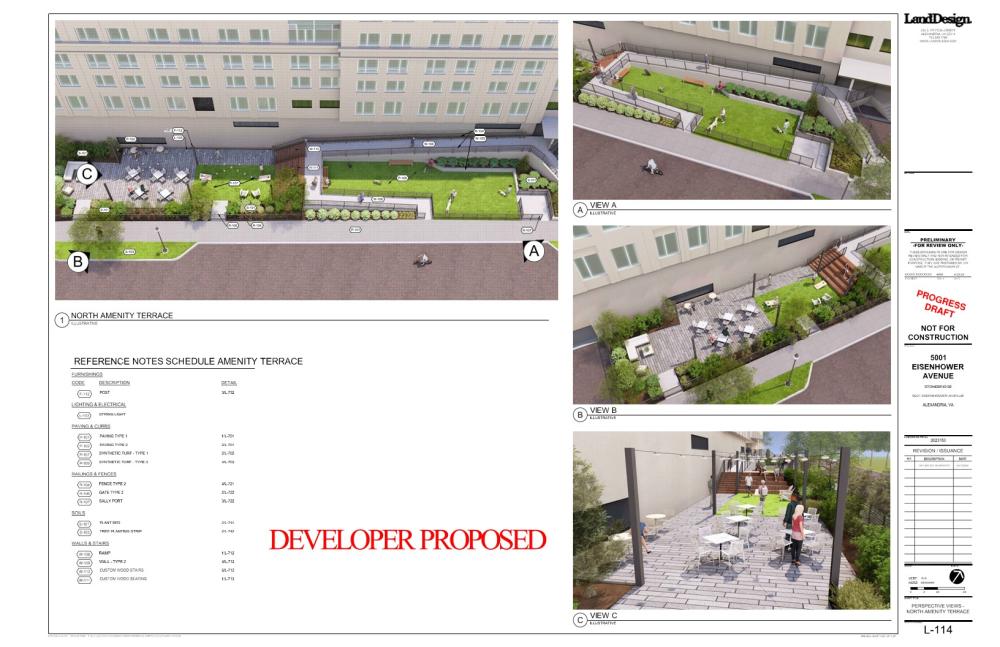

- Open Space

- The Development Approvals provides for public open space areas to be privately maintained in perpetuity subject to an easement

Future Development Details

- 50+/- townhomes rented at market rate

- 400+/- multifamily dwelling units rented at market rate

- Day Care Space

- 10,000+/- sq. ft. of space reserved for a daycare facility

- Discounted rent ($10 per sq. ft.) for 40 years

- If daycare use is not ultimately feasible, the City and Developer may mutually agree upon another use with discounted rent for community benefit

- The City and Developer will detail time frames, period for marketing the space, details about how decisions about the chosen user will be made, and other terms in the performance agreement

- Retail Space

- 5,000+/- sq. ft. of space for retail uses

- If retail is not viable after a reasonable period of marketing space, to be detailed in the agreement, space may be converted to building amenities

- Open Space

- The CDD Concept Plan provides for additional public open space areas to be privately maintained in perpetuity subject to an easement

- Day Care Space

- Development to be consistent with Coordinated Development District (CDD) and Development Special Use Permit (DSUP) as well as other City land use requirements

Developer’s Construction Timing Requirements

- Conversion Building (Phase I)

- Commence construction within 2 years

- Complete construction within 4.5 years

- If timelines are not met, the agreement may be terminated and waivers revoked

- Future Development

- First 50 units (townhomes): complete construction within 6 years (Phase II)

- Units 51-450 (multifamily): complete construction within 15 years (Phase III)

- Includes open space, day care, and retail

- This period will be extended to 16 years if timeline for Phase II is met

- If Phase II and Phase III construction timelines are not met, the time period for providing rent-controlled units will be extended to 45 or 50 total years

- The City Manager may extend the construction timelines up to 12 months if the Developer is making good-faith progress

City’s Financial Participation

- If approved by City Council, the City will provide a partial real estate tax exemption on the improvement value of the Conversion Building for 25 years estimated between $13.6M and $16.4M in net present value (NPV) dollars

- Abatement Years:

- Years 1-5: 90% abatement

- Years 6-10: 80% abatement

- Years 11-15: 70% abatement

- Years 16-20: 60% abatement

- Years 21-25: 50% abatement

- The partial real estate tax abatement will not exceed a maximum of $1.5 million annually

- Cumulative cap will not exceed $31.25 million unless certain atypical real estate tax rate conditions are met, and in no case will exceed $34.375 million

- If approved by City Council, the City will waive the Affordable Housing Trust Fund fee for the Conversion Building, estimated at $797,551.00 in 2024 dollars.

Background

5001 Eisenhower Avenue is a large, outdated office building on a 9.73-acre site, originally constructed in 1973 for the U.S. Army Material Command. Since that agency’s move to Ft. Belvoir in 2003, the 600,000+ SF building has been vacant. Despite the efforts of two owners over 21 years to identify and secure federal tenants, the most likely user of an office building of this size and orientation, no lease was ever executed. The building’s chronic vacancy has significantly raised Alexandria’s total office vacancy rate and is a contributing impediment to significant Eisenhower West redevelopment activity.

Most recently, in 2019, in an effort to induce commercial activity, the City granted the owner, an affiliate of Stonebridge, a partial real estate tax abatement to make the site conducive to office redevelopment and leasing. Similar to a previous partial real estate tax abatement granted for the site, these proposed projects were not realized because office tenants never leased the facility.

The City has also granted development requests and Development Special Use Permits to improve the building’s marketability as an office space - to allow for the construction of street level retail and for the construction of housing on a portion of the site. These changes, and the previously granted tax abatement, still have not induced office tenancy.

With that in mind, and in light of the current post-pandemic state of the office market, the property owner has determined that conversion of the existing building to residential use is its highest and best use. At the owner’s request and, because of this proposed change of use, City and Alexandria Economic Development Partnership (AEDP) staff have evaluated the viability of 5001 Eisenhower Avenue remaining an office building. Based on the building’s age, location, floorplate, and ceiling heights, the owner’s inability to lease the building with office users over multiple decades—even with City incentives offered—AEDP and City staff concur that the building is obsolete for office use. The building is responsible for approximately 3% of the City’s office vacancy rate (City’s 2024 midyear vacancy is 15.5%).

The building owner requested that City staff review a potential opportunity to utilize City financial participation, in the form of partial tax abatement on improvements to the building, to encourage the developer to incorporate a significant number of committed affordable and workforce units into the residential conversion of the building. City staff have reviewed the request to utilize City financial participation (in the same format as previously approved - partial tax abatement) to achieve two of the City’s strategic priorities- continued reinvestment and conversion of obsolete office buildings to return it to active use, and creation of affordable housing units. The existing Redevelopment District can be repurposed to structure City financial participation to induce/catalyze the conversion of a challenging commercial building to residential use while also meeting Alexandria’s need for committed affordable and workforce housing. In addition to the committed affordable and workforce rental units, conditions of the proposed City financial participation also require future development adjacent to the existing building as well as other community benefits.

During the November 12, 2024 Legislative Meeting, the City Manager provided details regarding the possible City financial participation and public benefits.

On December 14, 2024, City Council adopted an ordinance to provide a performance based partial real estate tax abatement to induce the redevelopment of 5001 Eisenhower Avenue, and authorized the City Manager to execute a performance agreement, with content not substantially different from that which is outlined in the term sheet.

Frequently Asked Questions

What is a tax abatement?

A tax abatement reduces the taxable value of a property for a prescribed period usually as an incentive to conduct significant repair, rehabilitation, or construction. The taxable amount is locked into a pre-improvement value for a period of time, as established by an ordinance. This temporarily reduces the tax burden, helping the property owner finance needed upgrades to a structure, or in some cases, a total replacement.

Virginia State Code Sec. 58.1-3219.4 allows localities to partially exempt from taxation improvements to real estate when located in a rehabilitation district for up to 30 years. The exemption is an amount equal to the increase in assessed value or a percentage of such increase resulting from the improvement to real estate. There is no tax exemption to the existing improvements, only the improvement value.

What are market affordable, committed affordable, workforce affordable, and market rate rental housing?

Affordability categories are based on how a household’s income compares to the average median income (AMI) for the same size household within a geographic or statistical area.

This table shows 2024 income levels for households of varying sizes. The U.S. Department of Housing & Urban Development (HUD) typically updates area rent and income limits each year, in the spring. The 2024 Median Family Income (MFI – or Area Median Income/AMI) for the Washington Metropolitan Area is $154,700 for a four-person household.

| % AMI | 1 Person | 2 People | 3 People | 4 People |

| 30% | $32,500 | $37,150 | $41,800 | $46,400 |

| 40% | $ 43,320 | $49,520 | $55,720 | $61,880 |

| 50% | $54,150 | $61,900 | $69,650 | $77,350 |

| 60% | $64,980 | $74,280 | $83,580 | $92,820 |

| MATH 80% | $86,640 | $99,040 | $111,440 | $123,760 |

| 100% | $108,300 | $123,800 | $139,300 | $154,700 |

| 120% | $129,960 | $148,560 | $167,160 | $185,640 |

Below are the 2024 rent levels established as “affordable” by the state low-income housing tax credit program (Virginia Housing) for different unit types based on household income levels, inclusive of projected utility adjustments.

| % AMI | Efficiency | 1BR | 2BR | 3BR |

| 30% | $813 | $871 | $1,045 | $ 1,207 |

| 40% | $1,083 | $1,161 | $1,393 | $ 1,609 |

| 50% | $1,354 | $1,451 | $1,741 | $ 2,011 |

| 60% | $1,625 | $1,741 | $2,090 | $ 2,414 |

| MATH 80% | $2,166 | $2,321 | $2,786 | $ 3,218 |

| 100% | $2,708 | $2,901 | $3,483 | $ 4,023 |

| 120% | $3,249 | $3,482 | $4,179 | $ 4,827 |

Committed affordable units: Housing units with rents affordable to households with gross incomes up to 60% of AMI. Typically, the government has intervened to make these lower rents possible by providing tax credits, funding and/or through land use tools requiring onsite affordable housing.

Market affordable units: Housing units that are also affordable to households with gross yearly incomes up to 60% of AMI. Absent government intervention, market affordable housing usually occurs because of a building’s age, condition, location (non-transit oriented), and/or lack of amenities.

Workforce affordable: Units with rents at levels affordable to households with incomes between 61%-80% AMI. These may be “market” (naturally occurring) or “committed.”

Market rate: Units with no controls on rents – rents and associated fees are set based on what the market will bear. They typically serve households with incomes at 81% AMI and greater.

Is the current proposed redevelopment consistent with the Eisenhower West Small Area Plan (EWSAP)?

The proposed rezoning and office-to-residential conversion are consistent with many of the objectives of both the plan-wide and neighborhood-specific elements of the EWSAP (including transportation and street connectivity, parks and open spaces, environmental sustainability and stormwater management) and City policies (Affordable Housing Policy, Green Building Policy, Public Art). In particular, the rezoning would enable the redevelopment of the surface parking lot on the western side of the building, complementing the ongoing construction of the Eisenhower Pointe townhome community on the former eastern parking lot. The proposal also provides committed affordable housing, a new street grid, improved Eisenhower Avenue streetscape, open spaces, and advances environmental sustainability goals consistent with the EWSAP. The plan had envisioned office at the site, but numerous prior proposals to reuse the existing building and construct new offices have failed to advance due to changing office needs and the economic climate. So, the applicant is seeking a change in the land use designation from office/institutional to mixed-use to accommodate the office-to-residential conversion of the existing building and future mixed-uses on the site. The multifamily development planned will likely increase use of public transit, including bus and metro, in the Eisenhower Avenue corridor.

What community outreach has occurred as part of the planning process for the proposed redevelopment?

The project has been presented at three meetings of the Eisenhower West/Landmark Van Dorn Implementation Advisory Group, first by City staff in September 2023 and subsequently by the applicant in November 2023 and on November 21, 2024 – the Advisory Group members supported the project and asked about the proposed density, open spaces, streetscape, parking, and student generation. The applicant has presented to The Eisenhower Partnership last winter. The applicant also presented its affordable housing plan at the November 18, 2024, meeting of the Alexandria Housing Affordability Advisory Committee, which endorsed the plan. On November 18, 2024, City staff discussed the project at the Environmental Policy Commission meeting, which voted to support the project. In addition, the applicant hosted a virtual community meeting on November 20, 2024, with about 30 attendees. The attendees asked about the construction timeline, parking for the parallel park, retail/commercial opportunities, pedestrian routes to the Van Dorn Metro Station, and the traffic impacts. Several residents said they welcomed the project.

What is the status of the planning process for the current redevelopment?

For the current planning process, the applicant first submitted plans in October 2023 to convert the Victory Center building from office to residential and to rezone the site, including the adjacent parking lot, to allow for future mixed-use redevelopment. The Coordinated Development District Concept Plan for the entire development and the Special Use Permit for the conversion building were approved by the Planning Commission during the hearing on December 3, 2024.

Community Engagement and Feedback

Opportunities for community engagement prior to Council Consideration of Financial Participation

- Public Presentation at Legislative Meeting: Tuesday, November 12, 2024

- Alexandria Housing Affordability Advisory Committee Meeting: Monday, November 18, 2024 6:30 p.m. - 7:15 p.m. (Virtual Only)

- Developer’s Project Specific Community Meeting: Wednesday, November 20, 2024 7:00 p.m.-8:30 p.m. (Virtual Only)

- Please submit any questions to: mrappolt@wiregill.com

- Eisenhower West/Landmark Van Dorn Implementation Advisory Group Meeting: Thursday, November 21, 2024 7:00 p.m. - 8:00 p.m.

- Planning Commission Hearing for Development Approvals: Tuesday, December 3, 2024

City Council Consideration of District Ordinance for Financial Participation

- First Reading at Legislative Meeting (No in-person public comments at this Legislative meeting. If you have a prepared statement or written comments for the record you may email it to the City Clerk at CouncilComment@alexandriava.gov.): Tuesday, December 10, 2024

- Second Reading at Public Hearing (In-person public comments will be received at this meeting. If you have a prepared statement or written comments for the record you may email it to the City Clerk at CouncilComment@alexandriava.gov.): Saturday, December 14, 2024

City Council Hearing for Development Approvals: Saturday, December 14, 2024